MYOB Support

Need help with your MYOB account, using a product or troubleshooting? Find technical support and help for all MYOB products here.

Support for your account

Billing and account

Update your payment method, pay your MYOB bills, edit your contact details and more.

Login and 2FA

Log in to your MYOB software and use two-factor authentication (2FA) as a second layer of protection.

Security

Data protection is our top priority. See our policies and privacy commitments, and find out how to keep your data secure.

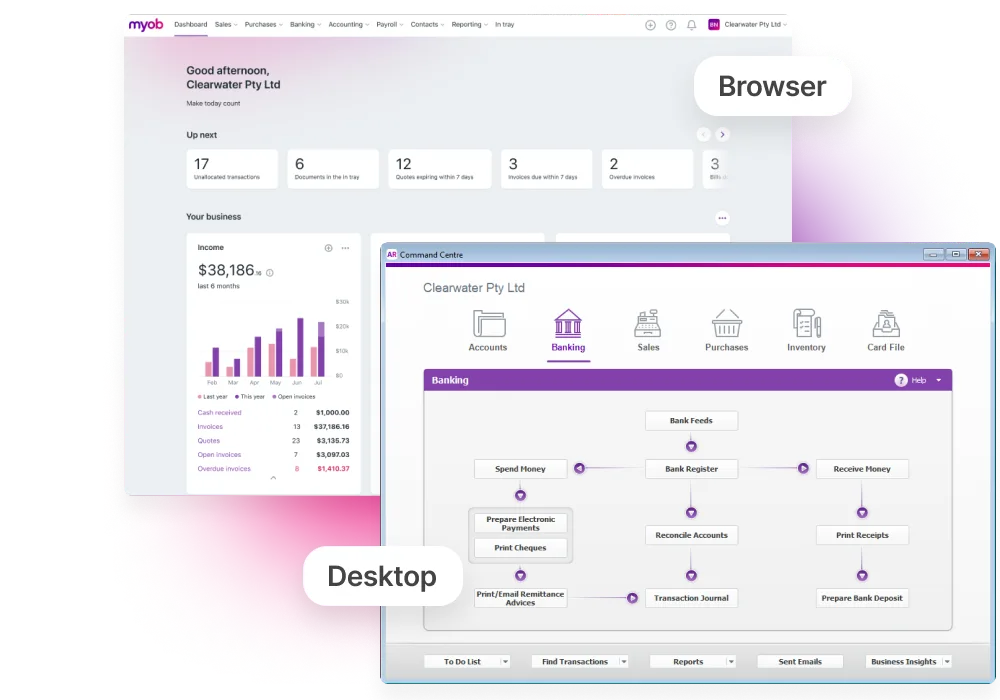

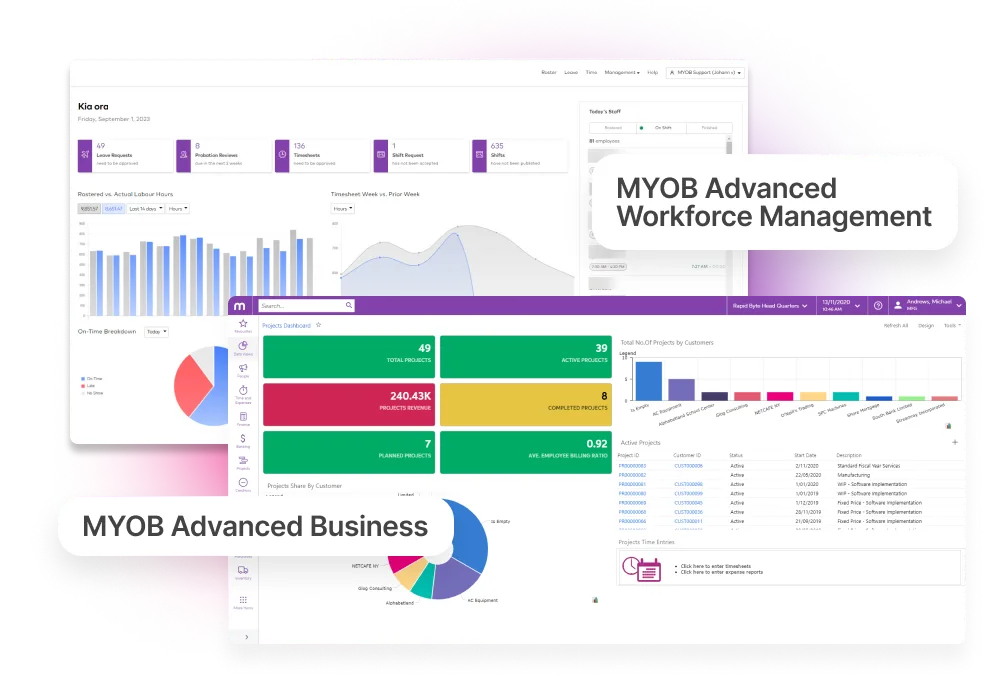

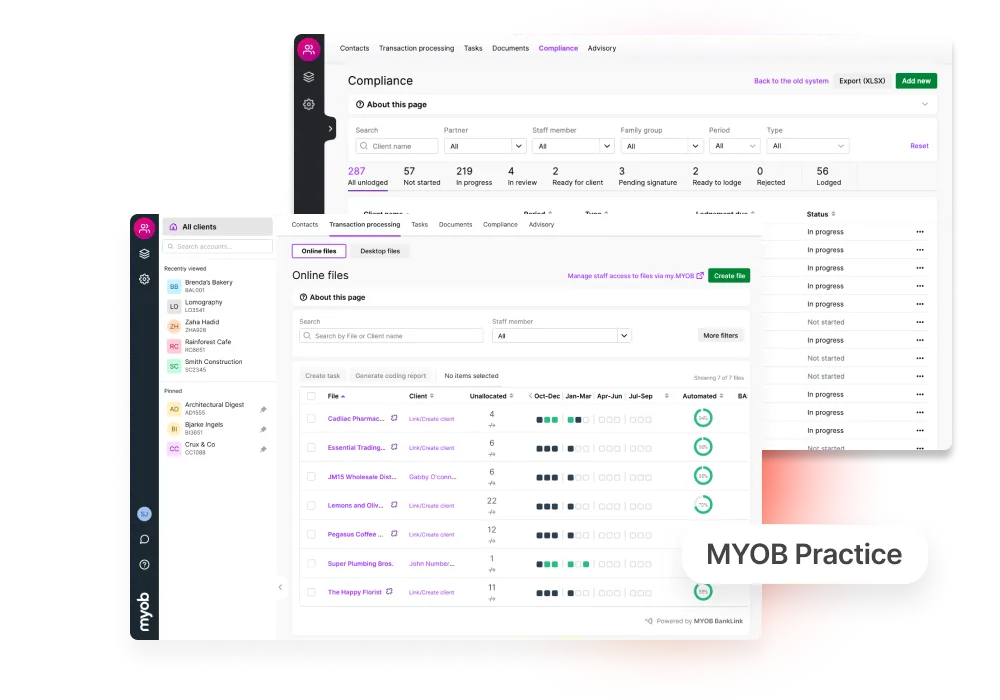

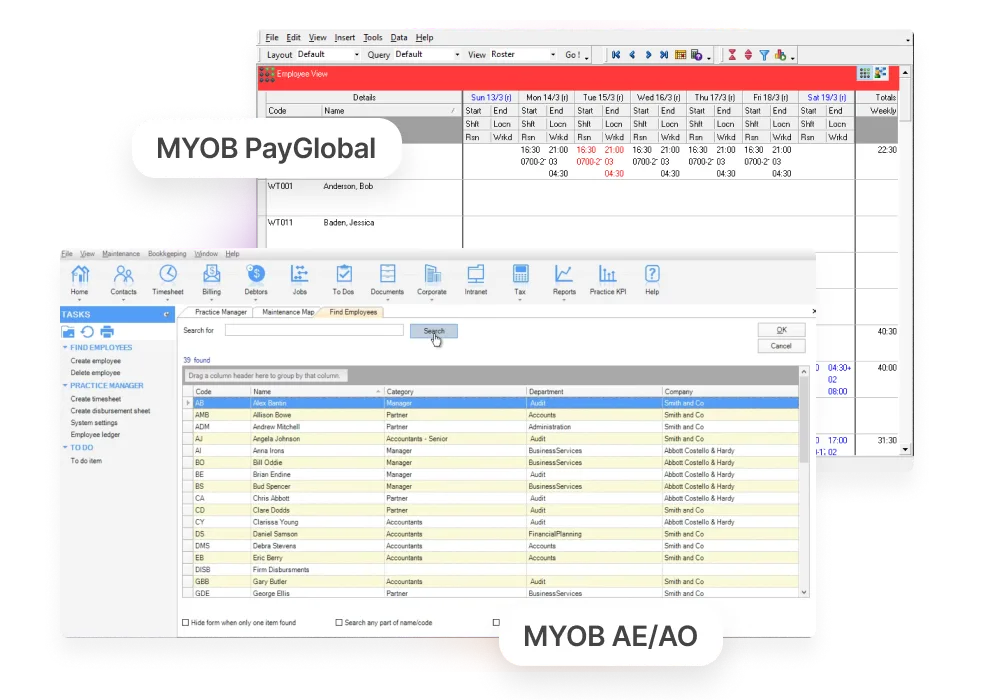

Support for your product